National Average For Mileage Reimbursement 2024

National Average For Mileage Reimbursement 2024. Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes. Car expenses and use of the standard.

On december 14, 2023, the internal revenue service (irs) announced the 2024 standard mileage rate. The increase began on january 1 and raised the rate from.

The 2024 Irs Standard Mileage Rates Are 67 Cents Per Mile For Every Business Mile Driven, 14 Cents Per Mile For Charity And 21 Cents.

At the end of last year, the internal revenue service published the new mileage rates for 2024.

You Can Calculate Mileage Reimbursement In Three Simple Steps:

Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

67 Cents Per Mile For Business Purposes;

Images References :

Source: rafaqkarisa.pages.dev

Source: rafaqkarisa.pages.dev

Cca Reimbursement 2024 Cost Tobye Gloriane, However, many drivers have been asking some important questions! National average weekly wages (naww) information for fiscal year 2024 is now available, a table of minimum and maximum compensation rates, and annual october.

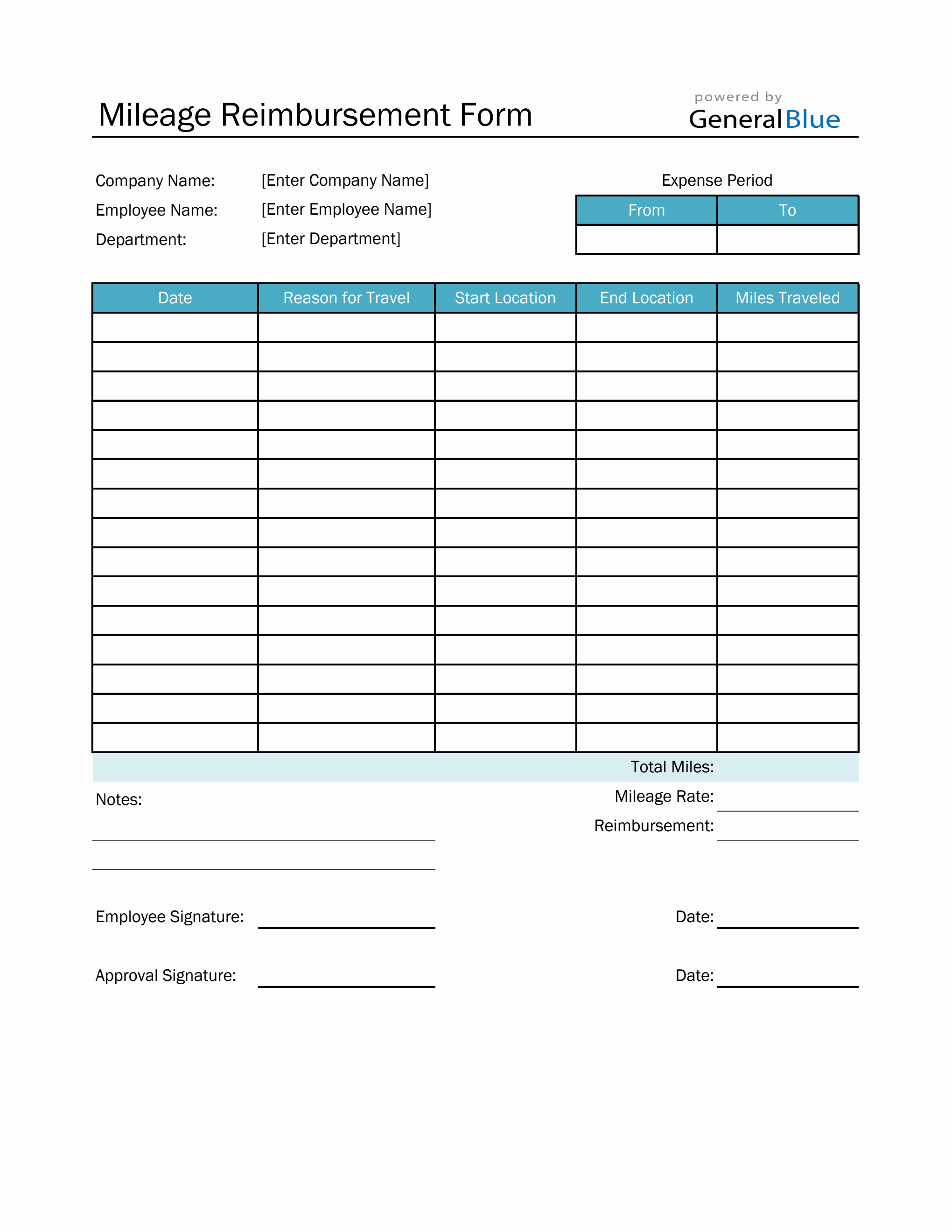

Source: www.generalblue.com

Source: www.generalblue.com

Mileage Reimbursement Form in Excel (Basic), While the 2024 business standard mileage rate has increased, the medical mileage rate of 21 cents per mile (which may be deductible under internal revenue code § 213 if it is. According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs of operating an automobile.”.

Source: ashlenqmaryrose.pages.dev

Source: ashlenqmaryrose.pages.dev

Typical Mileage Reimbursement 2024 channa chelsey, Effective from january 1, 2024, the irs has set the following standard mileage rates: According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs of operating an automobile.”.

Source: adelebdanyelle.pages.dev

Source: adelebdanyelle.pages.dev

Current Mileage Reimbursement 2024 Gwynne Hildegaard, While the 2024 business standard mileage rate has increased, the medical mileage rate of 21 cents per mile (which may be deductible under internal revenue code § 213 if it is. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.

Source: cardata.co

Source: cardata.co

Massachusetts Mileage Reimbursement Basics Cardata, The irs performs an annual study to determine the average amount of business miles traveled in the previous year when calculating mileage rates for the. While the 2024 business standard mileage rate has increased, the medical mileage rate of 21 cents per mile (which may be deductible under internal revenue code § 213 if it is.

Source: es.cs-finance.com

Source: es.cs-finance.com

El reembolso nacional promedio por millaje Los Basicos 2024, However, many drivers have been asking some important questions! 67 cents per mile driven for business use,.

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, The 2023 mileage rate was 65.5 cents per mile driven for business use. You can calculate mileage reimbursement in three simple steps:

Source: www.aiophotoz.com

Source: www.aiophotoz.com

2023 Reimbursement Form Fillable Printable Pdf And Forms Handypdf, 67 cents per mile driven for business use,. 67¢ per mile driven for business (up 1.5¢ from the 2023 rate) 21¢ per mile driven for medical or moving purposes.

Source: nonprofitupdate.info

Source: nonprofitupdate.info

Revised federal mileage rates for last half of 2022. Nonprofit update., The irs sets a standard mileage rate each year to simplify mileage reimbursement. The 2024 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents.

Source: smallbiztrends.com

Source: smallbiztrends.com

IRS Announces 2024 Mileage Reimbursement Rate, For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. While the 2024 business standard mileage rate has increased, the medical mileage rate of 21 cents per mile (which may be deductible under internal revenue code § 213 if it is.

On December 14, 2023, The Internal Revenue Service (Irs) Announced The 2024 Standard Mileage Rate.

67 cents per mile driven for business use,.

The Standard Business Mileage Rate Increases By 1.5 Cents To 67 Cents Per Mile.

However, many drivers have been asking some important questions!